Qualified trainees, students and skilled workers are in high demand in the maritime industry and logistics. LOGISTICS PILOT asked key players what employers in Bremen and Lower Saxony need to offer and which measures truly retain employees.

Qualified trainees, students and skilled workers are in high demand in the maritime industry and logistics. LOGISTICS PILOT asked key players what employers in Bremen and Lower Saxony need to offer and which measures truly retain employees.

United by a common goal – the sustainable transformation of the industry – a wide variety of players from the port and logistics industry will gather in Bremen when ENVOCONNECT opens its doors for the third time this year. But how far has Germany actually come in terms of sustainability? And which areas are currently being worked on most intensively?

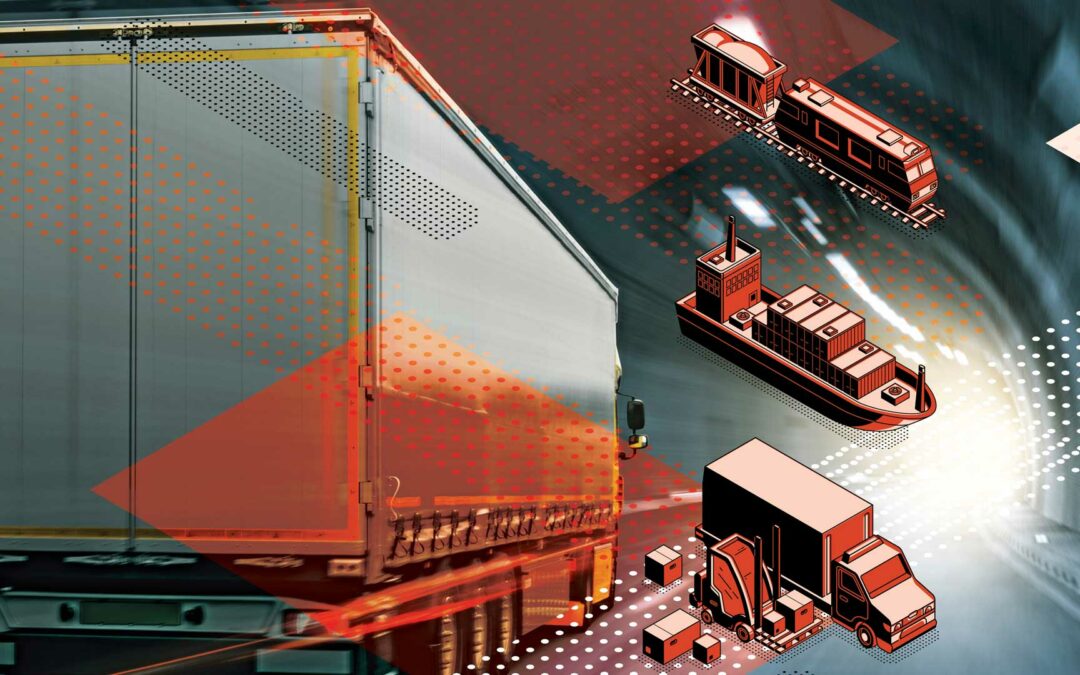

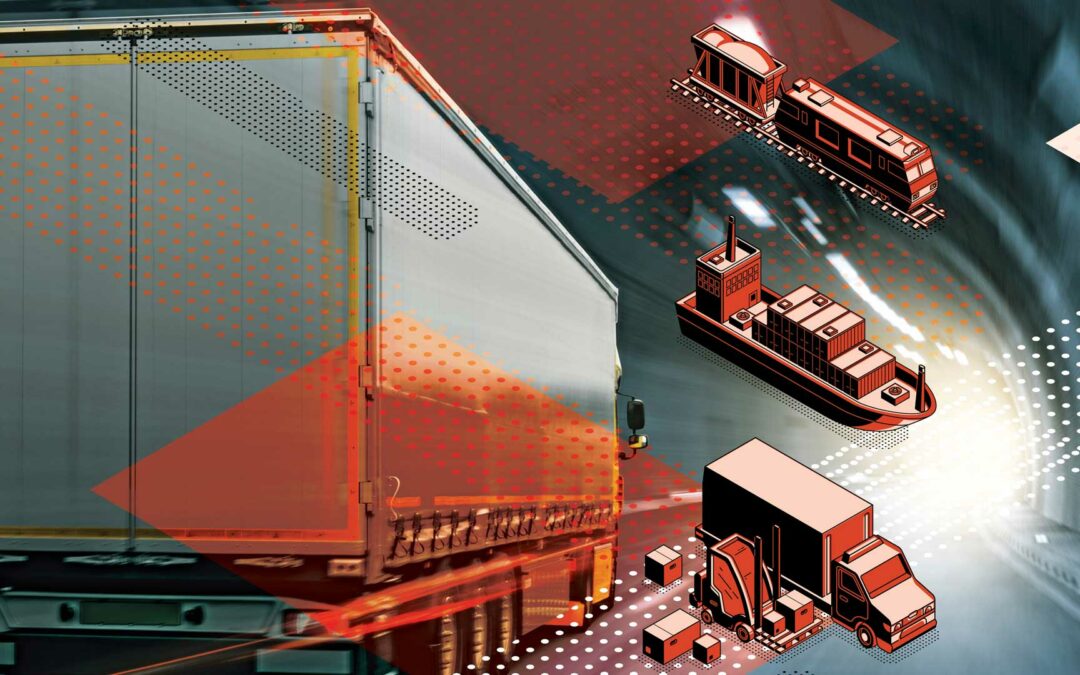

According to the “Traffic Forecast 2040” presented in October 2024, traffic in Germany will grow significantly by 2040, especially in the freight sector. The Federal Ministry for Digital and Transport Affairs (BMDV) estimates that transport volume will increase by around a third compared to 2019 – from 689 to 905 billion tonne-kilometres. This development will also pose numerous challenges for the infrastructure of the ports in the hinterland. Nevertheless, strategies and projects are already in place that integrate lorry, rail and land waterway transportation in different ways.

The maritime industry is facing major challenges, and not only with regard to the energy transition and the transformation to a climate-neutral economy. Market players also have to contend with geopolitical conflicts and cyberattacks. Experts from the Kiel Institute for the World Economy, the Association of German Seaport Operators, the Fraunhofer Centre for Maritime Logistics and Services and the German Maritime Institute view this explosive cocktail from their respective standpoints – and have various ideas for cooperation.

No matter whether they are tall, wide or heavy – companies that are competing for customers in project logistics, the break-bulk segment or for high-and-heavy orders are currently facing numerous challenges. Feedback from selected experts at BBC Chartering, Karl Gross, Cuxport, Atlantik Hafenbetriebe and J. MÜLLER shows that, above all, current geopolitical developments, rising costs and weakening economies require a great deal of flexibility and courage from those concerned.

The global volume of trade is growing, as is the demand for increased climate protection. The intention behind the National Ports Strategy adopted by the German government is to facilitate a more sustainable future for our ports. Can it succeed?

Does it make more sense for promising business communication to rely on good old personal contact, such as in meetings and at trade fairs, or should companies focus more on digital communication? And what challenges does the use of artificial intelligence (AI) as a possible tool for digital communication pose? Experts from BLG LOGISTICS, Kühne+Nagel, KPMG and the German Research Centre for Artificial Intelligence provide insights into their communication experiences and outlooks on possible developments.

All eyes have been on Baltimore recently – the collision between the “Dali” and a bridge has fuelled much discussion regarding shipping accidents. In light of this, experts from the German Central Command for Maritime Emergencies in Cuxhaven, the Otto Wulf company, the Bremen Freight Forwarders Association and HDI Global outline their specific views on incidents at sea and their consequences for the maritime environment.

The world is in flux – things we once understood to be true are now different. But how are developments as diverse as the post-pandemic boom in new builds, piracy in the Red Sea and China’s geopolitical aims affecting the maritime economy? And how do all these puzzle pieces fit together?

According to the “Economic Costs of Climate Change” study, commissioned by the Federal Ministry for Economic Affairs and Climate Action, Germany could face costs of up to 900 billion euros by the middle of the century. There are a wide range of reasons for this, including product and raw material supply bottlenecks, damage to buildings and infrastructure and the implementation of environmental and climate protection measures. The industry is tackling the latter challenge in very different ways, including with subsidies.

In recent years, logistics and the maritime industry have launched countless activities that are either sustainable or designed to combat climate change. Ten such projects from the ports of Bremen and Lower Saxony demonstrate the focus by those responsible on a wide range of alternative solutions, charting the course for future generations to do the same.

After a boom phase last year, the development of the global financial markets, the steep rise in inflation and the resulting uncertainties, among other things, have ensured that the key players on the logistics real estate market are acting rather cautiously at present. They do, however, have complex ideas on how to proceed – especially with a stronger focus on sustainability, digitalisation and increased attractiveness.

The German job market in general, and logistics in particular, are in a state of flux. Both are influenced by, among other things, baby boomers reaching retirement age, a shortage of skilled workers, apprenticeship vacancies and employees’ reassessment of their private and professional lives.

Where exactly are we on our path towards digitalisation and automation, and where will it take us? Where are the stumbling blocks, and what’s the best way to advance digitalisation? One thing is clear – speed isn’t everything, but we shouldn’t underestimate it either.

No discussion about Germany’s maritime sector would be complete today without the terms “national port strategy” and “port cooperation” cropping up at some stage. However, those responsible for ports in each German state and the stakeholders have very different views on how things are developing. They do agree, though, that Berlin has a decisive influence on both the direction we will need to row in the future and how quickly. Moreover, each location wants to emphasise its individual qualities as a universal port.

If you see and hear the rumblings in the world today, you might be forgiven for feeling that many places are already bidding globalisation a loud farewell. How realistic is this, though, and how far should Germany detach itself from China or other trading powers as all this unfolds?

We are living in challenging times, and companies in Germany, Austria and Switzerland are feeling the effects of this. There are even rumours behind closed doors that we are sitting on a powder keg, so to speak. One thing is certain, though – following the latest developments, logistics experts have gathered experience that is now being incorporated into very specific solution strategies.

Since Poland joined the EU in 2004, it has demonstrated impressive, economic development. However, the world market situation has not stopped at the country’s borders, as experts in the local logistics market are quick to testify.

Just a few months ago, ‘The Economist’ named Italy ‘Country of the Year 2021’. Yet, on the Italian peninsula, too, the economic upswing has been slowed down by the effects of the war in Ukraine. However, the country has a plan.

How Brexit is playing out may differ in the UK and on the continent. However, the crisis in Ukraine is now welding Europe closer together again – regardless of EU membership. The period of bipolarity between the UK and the EU is likely to be over for the time being, with potentially positive effects on trade too.

Two countries, numerous strengths: industry experts shed light on what distinguishes the Netherlands and Belgium – and what sets them apart from Germany. The topic of port cooperation automatically appears on the agenda.

Expo 2020, which is still running in Dubai until 31 March, is currently garnering the United Arab Emirates (UAE) global media coverage. This kind of attention is very welcome for the country, which is a federation of seven autonomous emirates. After all, one of its top priorities for 2022 is a rapid economic recovery from the Covid-19 pandemic.

Singapore – living up to its title as the Lion’s City. The metropolis is also one of four major economies comprising the ‘Tiger States’ in Asia, marked by exponential economic growth in the second half of the twentieth century. It therefore comes as no surprise that the city-state is considered an apex player today – especially when it comes to finance and global trade of goods.

Slovakia, the Czech Republic and Hungary have many things in common. They are not only export nations but are also important locations for the automotive and supplier industries too. By contrast, however, inland waterway transport in these countries tends to take second stage.

The experts all agree: although the pandemic has been slowing down development in North Africa for over a year, Egypt, Algeria, Libya, Morocco and Tunisia will continue to expand their role as Germany‘s trading partners over the long term.

JAPAN. Japan is known for being a pioneer. To keep it that way, the country not only finalised a series of directives and trade agreements, but is also placing greater focus on digitisation and new technology.

AUSTRIA. Despite all the competition between Austrians and Germans, one thing is clear: one can’t do without the other in many areas. In the following, experts shed light on the economic and logistical interrelationships between the two countries – and present successful projects and construction sites.

BALTIC STATES. Neither in terms of their area – around 175,000 square kilometres – nor their total population – over six million – can the Baltic states be called real giants. However, they do score points as attractive hubs in east-west trade furnished with well-trained staff and a well-developed infrastructure. Above all, however, they are real pioneers when it comes to digitisation.

INDIA. A market with almost 1.4 billion people, growth rates of up to eight percent per annum and a young, largely consumption-friendly population – India holds tremendous economic potential. But seizing this potential requires overcoming some hurdles.

LATIN AMERICA. Since the beginning of the year, the pandemic has been causing considerable disruption to global logistics chains to and from Latin America. Experts are watching with concern, but nevertheless see signs of long-term growth potential in the region.

Some talk of collaborations and networks, others of alliances. Regardless of the terminology used, the underlying concept is always one of pooling strengths – for example, sharing risks, reducing costs or accessing new markets. Especially in times of complex global challenges, such as those we face today, this type of collaboration seems to be developing into an efficient (survival) strategy.

Qualified trainees, students and skilled workers are in high demand in the maritime industry and logistics. LOGISTICS PILOT asked key players what employers in Bremen and Lower Saxony need to offer and which measures truly retain employees.

United by a common goal – the sustainable transformation of the industry – a wide variety of players from the port and logistics industry will gather in Bremen when ENVOCONNECT opens its doors for the third time this year. But how far has Germany actually come in terms of sustainability? And which areas are currently being worked on most intensively?

According to the “Traffic Forecast 2040” presented in October 2024, traffic in Germany will grow significantly by 2040, especially in the freight sector. The Federal Ministry for Digital and Transport Affairs (BMDV) estimates that transport volume will increase by around a third compared to 2019 – from 689 to 905 billion tonne-kilometres. This development will also pose numerous challenges for the infrastructure of the ports in the hinterland. Nevertheless, strategies and projects are already in place that integrate lorry, rail and land waterway transportation in different ways.

The maritime industry is facing major challenges, and not only with regard to the energy transition and the transformation to a climate-neutral economy. Market players also have to contend with geopolitical conflicts and cyberattacks. Experts from the Kiel Institute for the World Economy, the Association of German Seaport Operators, the Fraunhofer Centre for Maritime Logistics and Services and the German Maritime Institute view this explosive cocktail from their respective standpoints – and have various ideas for cooperation.

No matter whether they are tall, wide or heavy – companies that are competing for customers in project logistics, the break-bulk segment or for high-and-heavy orders are currently facing numerous challenges. Feedback from selected experts at BBC Chartering, Karl Gross, Cuxport, Atlantik Hafenbetriebe and J. MÜLLER shows that, above all, current geopolitical developments, rising costs and weakening economies require a great deal of flexibility and courage from those concerned.

The global volume of trade is growing, as is the demand for increased climate protection. The intention behind the National Ports Strategy adopted by the German government is to facilitate a more sustainable future for our ports. Can it succeed?

Does it make more sense for promising business communication to rely on good old personal contact, such as in meetings and at trade fairs, or should companies focus more on digital communication? And what challenges does the use of artificial intelligence (AI) as a possible tool for digital communication pose? Experts from BLG LOGISTICS, Kühne+Nagel, KPMG and the German Research Centre for Artificial Intelligence provide insights into their communication experiences and outlooks on possible developments.

All eyes have been on Baltimore recently – the collision between the “Dali” and a bridge has fuelled much discussion regarding shipping accidents. In light of this, experts from the German Central Command for Maritime Emergencies in Cuxhaven, the Otto Wulf company, the Bremen Freight Forwarders Association and HDI Global outline their specific views on incidents at sea and their consequences for the maritime environment.

The world is in flux – things we once understood to be true are now different. But how are developments as diverse as the post-pandemic boom in new builds, piracy in the Red Sea and China’s geopolitical aims affecting the maritime economy? And how do all these puzzle pieces fit together?

According to the “Economic Costs of Climate Change” study, commissioned by the Federal Ministry for Economic Affairs and Climate Action, Germany could face costs of up to 900 billion euros by the middle of the century. There are a wide range of reasons for this, including product and raw material supply bottlenecks, damage to buildings and infrastructure and the implementation of environmental and climate protection measures. The industry is tackling the latter challenge in very different ways, including with subsidies.

In recent years, logistics and the maritime industry have launched countless activities that are either sustainable or designed to combat climate change. Ten such projects from the ports of Bremen and Lower Saxony demonstrate the focus by those responsible on a wide range of alternative solutions, charting the course for future generations to do the same.

After a boom phase last year, the development of the global financial markets, the steep rise in inflation and the resulting uncertainties, among other things, have ensured that the key players on the logistics real estate market are acting rather cautiously at present. They do, however, have complex ideas on how to proceed – especially with a stronger focus on sustainability, digitalisation and increased attractiveness.

The German job market in general, and logistics in particular, are in a state of flux. Both are influenced by, among other things, baby boomers reaching retirement age, a shortage of skilled workers, apprenticeship vacancies and employees’ reassessment of their private and professional lives.

Where exactly are we on our path towards digitalisation and automation, and where will it take us? Where are the stumbling blocks, and what’s the best way to advance digitalisation? One thing is clear – speed isn’t everything, but we shouldn’t underestimate it either.

No discussion about Germany’s maritime sector would be complete today without the terms “national port strategy” and “port cooperation” cropping up at some stage. However, those responsible for ports in each German state and the stakeholders have very different views on how things are developing. They do agree, though, that Berlin has a decisive influence on both the direction we will need to row in the future and how quickly. Moreover, each location wants to emphasise its individual qualities as a universal port.

If you see and hear the rumblings in the world today, you might be forgiven for feeling that many places are already bidding globalisation a loud farewell. How realistic is this, though, and how far should Germany detach itself from China or other trading powers as all this unfolds?

We are living in challenging times, and companies in Germany, Austria and Switzerland are feeling the effects of this. There are even rumours behind closed doors that we are sitting on a powder keg, so to speak. One thing is certain, though – following the latest developments, logistics experts have gathered experience that is now being incorporated into very specific solution strategies.

Since Poland joined the EU in 2004, it has demonstrated impressive, economic development. However, the world market situation has not stopped at the country’s borders, as experts in the local logistics market are quick to testify.

Just a few months ago, ‘The Economist’ named Italy ‘Country of the Year 2021’. Yet, on the Italian peninsula, too, the economic upswing has been slowed down by the effects of the war in Ukraine. However, the country has a plan.

How Brexit is playing out may differ in the UK and on the continent. However, the crisis in Ukraine is now welding Europe closer together again – regardless of EU membership. The period of bipolarity between the UK and the EU is likely to be over for the time being, with potentially positive effects on trade too.

Two countries, numerous strengths: industry experts shed light on what distinguishes the Netherlands and Belgium – and what sets them apart from Germany. The topic of port cooperation automatically appears on the agenda.

Expo 2020, which is still running in Dubai until 31 March, is currently garnering the United Arab Emirates (UAE) global media coverage. This kind of attention is very welcome for the country, which is a federation of seven autonomous emirates. After all, one of its top priorities for 2022 is a rapid economic recovery from the Covid-19 pandemic.

Singapore – living up to its title as the Lion’s City. The metropolis is also one of four major economies comprising the ‘Tiger States’ in Asia, marked by exponential economic growth in the second half of the twentieth century. It therefore comes as no surprise that the city-state is considered an apex player today – especially when it comes to finance and global trade of goods.

Slovakia, the Czech Republic and Hungary have many things in common. They are not only export nations but are also important locations for the automotive and supplier industries too. By contrast, however, inland waterway transport in these countries tends to take second stage.

The experts all agree: although the pandemic has been slowing down development in North Africa for over a year, Egypt, Algeria, Libya, Morocco and Tunisia will continue to expand their role as Germany‘s trading partners over the long term.

JAPAN. Japan is known for being a pioneer. To keep it that way, the country not only finalised a series of directives and trade agreements, but is also placing greater focus on digitisation and new technology.

AUSTRIA. Despite all the competition between Austrians and Germans, one thing is clear: one can’t do without the other in many areas. In the following, experts shed light on the economic and logistical interrelationships between the two countries – and present successful projects and construction sites.

BALTIC STATES. Neither in terms of their area – around 175,000 square kilometres – nor their total population – over six million – can the Baltic states be called real giants. However, they do score points as attractive hubs in east-west trade furnished with well-trained staff and a well-developed infrastructure. Above all, however, they are real pioneers when it comes to digitisation.

INDIA. A market with almost 1.4 billion people, growth rates of up to eight percent per annum and a young, largely consumption-friendly population – India holds tremendous economic potential. But seizing this potential requires overcoming some hurdles.

LATIN AMERICA. Since the beginning of the year, the pandemic has been causing considerable disruption to global logistics chains to and from Latin America. Experts are watching with concern, but nevertheless see signs of long-term growth potential in the region.

You are currently viewing a placeholder content from Facebook. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou need to load content from hCaptcha to submit the form. Please note that doing so will share data with third-party providers.

More InformationYou need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Turnstile. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information